Do you wish to become rich in near future? Here we are going to share some secret ways to become rich with zero investment. To become rich, you have lots of options in market. But the irony is that most of the techniques to get rich will not be suitable for you. Many people want to follow the ongoing trends with high competition and fail even after hard working. So, be unique and think in a different way.

Here are the three basic techniques that sounds better for you.

If you want to be rich person, you have the first option to grab an expensive degree from a reputed college and claim a job after giving too much efforts in study. It takes time but you will obviously become rich after getting a job.

The second option is to bring a revolutionary business idea in the market and execute it properly with necessary funding. Wait till the point of ultimate valuation of your company and exit from the company getting a high profit margin without future risk management.

But if you don’t like short term and time-consuming ways to get started, you have the third and best option to execute. You have to buy multiple assets that generate income for life time and make you wealthy with financial freedom.

IN THIS ARTICLE

List of 5 secret ways to become rich with asset investment

1. Art Investing

Art investment is one of the most favourite assets that is highly valuable among rich people. This investment lies in its potential for substantial returns and its ability to act as a hedge against market volatility. Unlike traditional financial instruments, art possesses intrinsic value and can appreciate over time. With the global art market continually expanding, investors have a plethora of options to explore, from established masters to emerging talents.

But the main problem is the lack of resources from where we can buy art forms. We don’t have much primary investment to buy an art from auctions and buy it physically, like rich people. Masterwork, Artsy are some of the platforms that give us option to buy and sell art form with low price. Either you can create your own art form if you have skills to implement or you can invest money by purchasing art from marketplaces and sell it later with growing market price.

2. Annuities Investment

An annuity investment contract is a financial instrument designed to offer a consistent income stream to an individual either for a specified period or throughout their lifetime. This arrangement involves a contractual agreement between an individual and an insurance company. The individual commits to making either a lump-sum payment or a series of payments to the insurer, and, in return, they receive regular disbursements.

For simplicity, you can consider the situation:

Suppose you have $1000 but you don’t want to start a business by taking market risk. Consequently, your friend asks for money you to start a business as he doesn’t have any other borrowing option and says he will not return the money in bulk but pays you $10 per month for lifetime after one year of business return.

To recover $1000, you need to wait almost 8 years and then all monthly payments will be profit for lifetime. He also earns a high profit from business growth. In this way, both of you minimize the financial burden. Annity will not work only if you do not live long enough, otherwise it will become a lifetime income source for you.

3. Real Estate Crowd Funding

Real estate crowdfunding businesses have revolutionized property investment dynamics, providing an attractive alternative for those seeking exposure to real estate markets. With its intuitive platforms, diversification benefits, and reduced entry barriers, real estate crowdfunding is set to reshape how individuals interact with real estate as an investment asset. As this innovative model progresses, investors and industry stakeholders can look forward to a more dynamic and inclusive real estate investment landscape.

You can invest your money in real estate properties without any hesitation as the price of real estate is never going to decrease with rising demand. Buy Bare Lands, Single-Family Homes, Multi-Family Dwellings, Industrial Properties, Commercial Properties and you can sell it at a higher price after 10-20 years without any financial risk.

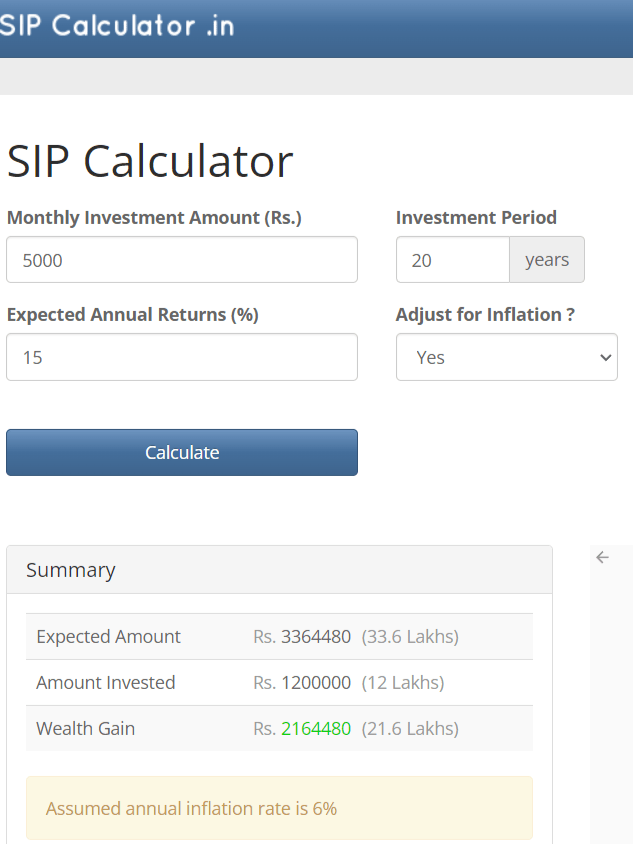

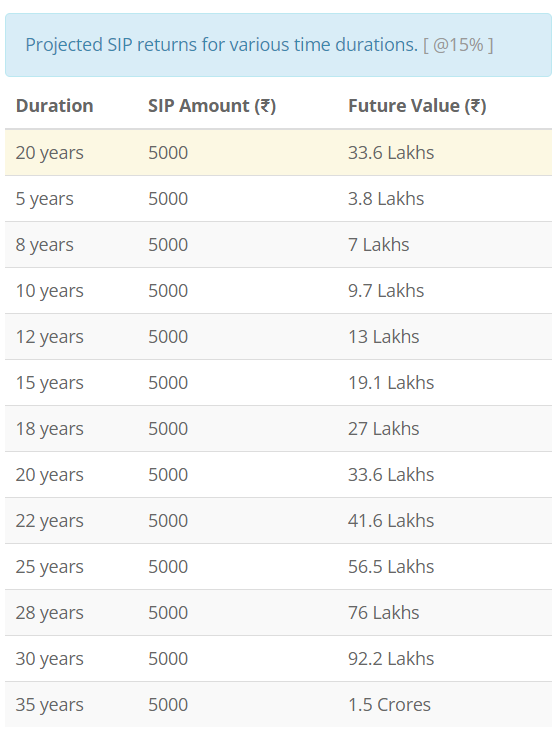

4. Mutual Fund Investment

Mutual fund investments present a compelling package of benefits, including risk reduction, expert management, and convenient features. As an accessible and cost-effective investment option, mutual funds continue to be an integral part of diversified investment portfolios, providing individuals with the tools to unlock their financial potential.

Investing money in mutual fund can make you rich after a period of 15-20 years of investment. Mutual fund works totally upon the power of compounding. Just follow the steps to select a beneficial fund without any issues:

- Define Your Financial Goals,

- Understand Your Risk Tolerance,

- Know Your Investment Time Horizon,

- Check Historical Performance,

- Assess Fees and Expenses,

- Check Fund Manager’s Track Record,

- Examine Fund Size and Assets Under Management,

- Consider Tax Implications,

- Seek Professional Advice.

In long term investment in mutual fund, the risk of loss can be neglected and you will get a high return with a minimum 12%-15% returns.

Related: 5 In-Demand Manufacturing Business Ideas

5. Investment in Jewelries

High-quality and rare gemstones, as well as precious metals, have the potential to retain or appreciate in value over time. However, it’s essential to acknowledge that such outcomes are not guaranteed, and the market for specific types of jewelry can experience fluctuations. But seeing the ongoing market trends, it is clear that investing money in Golds, Silver, Diamond etc. never disappoint you in future.

Simply, you can buy sufficient amounts of jewelries, and store it for 20 years and sell it when market price of such metals become twice or thrice of the present price. You can use the jewelries if you want as using of precious metal never deem its quality and value.

Consider the key points before investing in jewelry:

- Retention of Quality and Value over times,

- Awareness of Trends and Fashion,

- Market Insight,

- Authenticity of the buying metals,

- Liquidity Considerations,

- Storage and Insurance.

Prior to making any investment decisions, seeking advice from financial professionals or experts in the jewelry industry is recommended. Additionally, aligning investment choices with individual financial goals, risk tolerance, and time horizon is essential when considering jewelry or any alternative asset.

Realize, investment in Bank or FD never make you rich, only it can safe your money from thieves or burglars. Only investing money in future demanding assets can make you a wealthy fellow. There are many other assets available here and there, but we recommend you to choose one from the above list to invest without any peril and enact to implement the secret ways to become rich.

1 comment

[…] Business […]